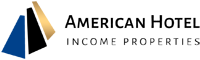

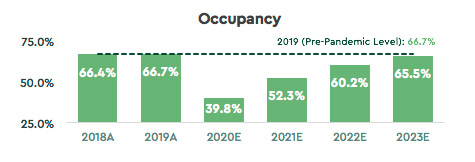

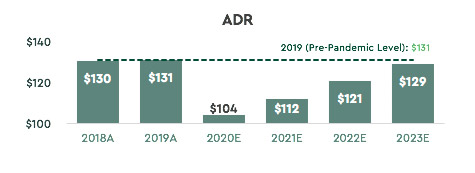

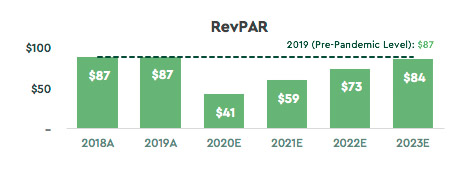

Historical precedent suggests that a clear path to recovery exists, as demonstrated by industry rebounds from recent black-swan events.

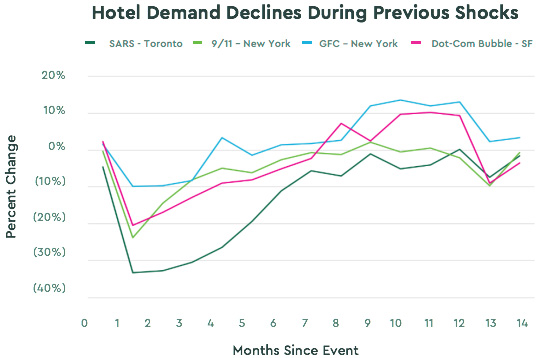

With expected discounts being in value compared to pre-pandemic levels, our Distressed Acquisition Strategy focuses on the unique buying opportunity created by the COVID-19 pandemic: acquiring North American hotel assets at attractive discounted prices which under more normal circumstances may not come to market.

With expected discounts being in value compared to pre-pandemic levels, our Distressed Acquisition Strategy focuses on the unique buying opportunity created by the COVID-19 pandemic: acquiring North American hotel assets at attractive discounted prices which under more normal circumstances may not come to market.